When a capital asset is sold the difference between the basis in the asset and the amount it is sold for is a capital gain or a capital.

Capital gains tax 2017 california.

Instead capital gains are taxed at the same rate as regular income.

The capital gains tax rate.

What you need to know for 2017 here s how your capital gains tax rates may be changing for 2017 and how to prepare.

The capital gains tax rates in the tables above apply to most assets but there are some noteworthy exceptions.

The current 2017 capital gains tax rates.

Individual income tax return irs form 1040 or 1040 sr and capital gains and losses schedule d irs form 1040 or irs form 1040 sr.

2017 capital gains rates.

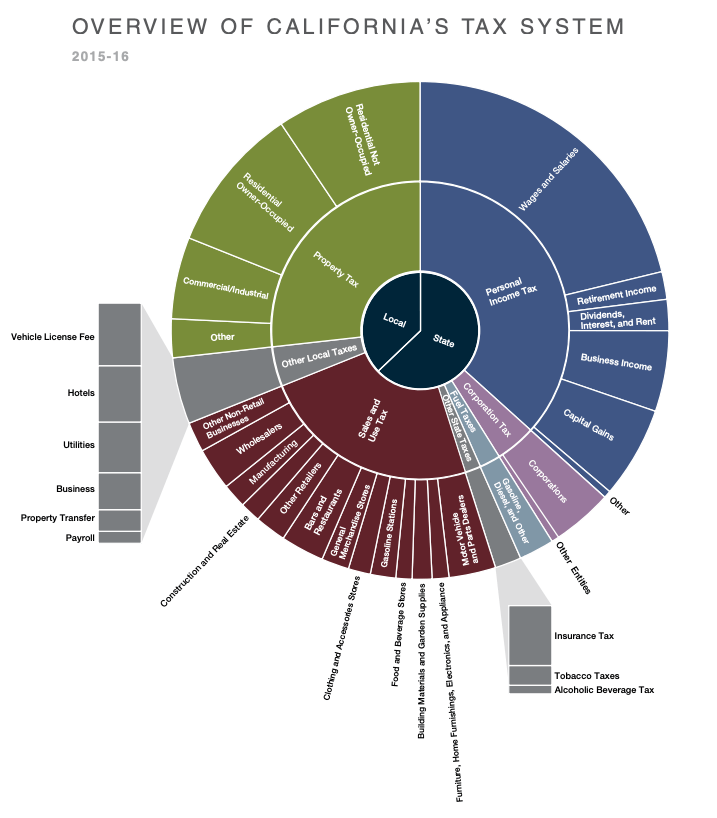

Currently individuals making 254 250 to 305 100 a year pay 10 3 in taxes with the rate increasing to 13 3 for those making 1 million or more.

Almost everything owned and used for personal or investment purposes is a capital asset.

The federal tax rate for your long term capital gains are taxed depends on where your income falls in relation to three cut off points.

Long term capital gains on so called collectible assets.

How to report federal return.

If you own a home you may be wondering how the government taxes profits from.

The usual high income tax suspects california new york oregon minnesota new jersey and vermont have high taxes on capital gains too.

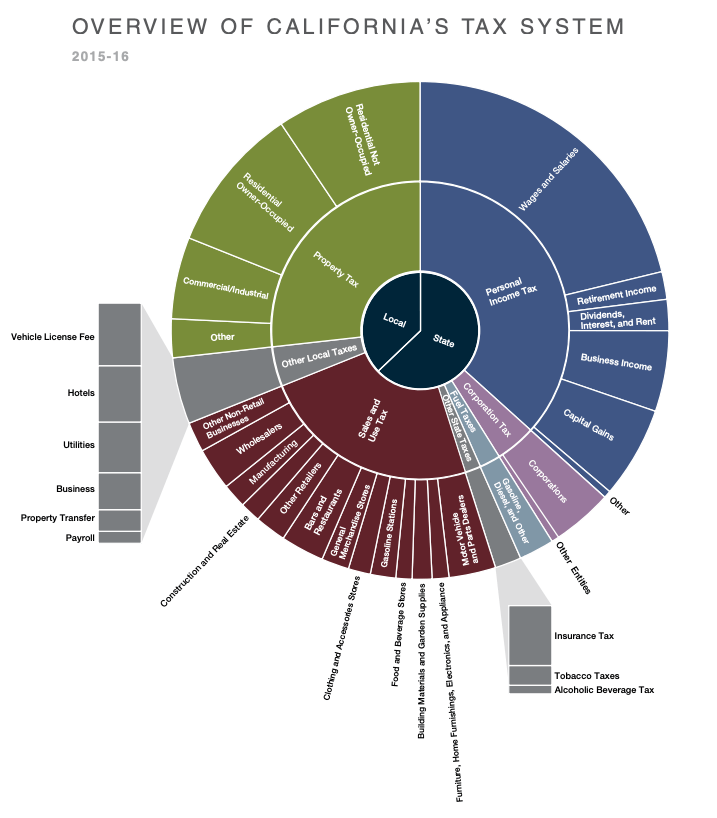

California taxes all capital gains as income unlike the federal government which differentiates between long term and short term capital gains.

California is known the world over for its picture perfect beaches and sunny weather.

To report your capital gains and losses use u s.

California does not tax long term capital gain at any lower rate so californian s pay up to 13 3 too.

California does not have a tax rate that applies specifically to capital gains.

1 examples are a home household furnishings and stocks or bonds held in a personal account.

Capital gains taxes on property.

2017 long term capital gain rates 0 if your income is below 37 950 and you are filing as single or below 75 900 for married filing jointly.

By paying 23 8 plus 13 3 californians are paying more on capital gain than virtually.

All capital gains are taxed as ordinary income.

Short term capital gains are profits made on investments you sell that were held for one.

If you have a difference in the treatment of federal and state.